Stores and malls are closing. Grocery sales are declining. Competition is intensifying. If you’re in the retail industry today, none of that is news. But what might be surprising to learn is that the numbers are not all bad—and leveraging brand power is making the difference for retailers and brands getting it right.

Stores and malls are closing. Grocery sales are declining. Competition is intensifying. If you’re in the retail industry today, none of that is news. But what might be surprising to learn is that the numbers are not all bad—and leveraging brand power is making the difference for retailers and brands getting it right.

In March, consumer confidence reached its highest level since December 2000, according to monthly reports from The Consumer Confidence Board. For the first time in over a year, data from market research firm Nielsen shows private brand shares on the rise for the past three four-week periods in a row. Proprietary research from Daymon shows that more than two-thirds of shoppers believe the brands they buy care about them and their families—and would recommend those brands to others.

So what can retailers and brands do to make sure they land on the winning side? To begin, they must realize that as consumers redefine value to include more than just dollars and cents, it’s no longer enough to compete solely on price. Leveraging the full power of brands (which includes the “brand” of retailers themselves) today has become a multi-service, multi-platform and multi-sensory endeavor.

To better understand which tactics resonate best with consumers, Daymon conducted two major consumer surveys in 2016. For its Retailer Radar Survey, nearly 4,000 consumers in North America were asked about their perceptions of and shopping habits for more than 80 major retailers in a wide variety of categories, including grocery, beauty, pet care and convenience. For its Brand Radar Survey, over 13,000 consumers were surveyed regarding more than 400 brands covering a range of categories.

“Our research shows that a lot is changing about our industry—the way consumers are shopping, making decisions, spending money and more,” says Joe Cook, Senior Director of Analytics for Daymon. “Many traditional tactics just aren’t working for the consumer anymore. Retailers must look hard at the investments they are making and choose those that are truly going to work best for them in terms of generating additional loyalty from their shoppers and getting a greater return.”

Let’s take a look at top retailers in three industries that Daymon has identified as leading the way in leveraging their brand power—and driving sales and consumer loyalty in the process.

Grocery: Publix Super Markets—Connecting through Service and Relatability

Grocery: Publix Super Markets—Connecting through Service and Relatability

Publix has consistently ranked as a top retailer on numerous consumer surveys, including the latest 2017 Harris Poll Reputation Quotient Study and Temkin Customer Experience Ratings. Where many other supermarket chains saw slim earnings of one-to-two percent in 2016, Publix boasted just over a three percent gain—and sales increases of over five percent.

Furthering the notion that it’s not enough to compete solely on price, Publix CEO Todd Jones told Forbes in an August 2013 issue that what sets Publix apart is that, “We believe that there are three ways to differentiate: service, quality and price. You’ve got to be good at two of them, and the best at one. We make service our number one, then quality and then price.”

To deliver the best possible service, Publix has long been known for empowering associates to take responsibility for every aspect of the in-store experience—and rewarding them in the process. (Publix regularly promotes from within; its current CEO started out with the company as a bagger.)

Daymon’s own research has shown that the Publix brand stands out amongst consumers for its trustworthiness and accessibility. Four out five consumers believe the retailer genuinely cares about them and their family and has a good reputation for being honest and fair. This extends to Publix private label offerings, with more than 80 percent of consumers—10 points higher than the industry average—saying they trust the products, feel items are made for them and would recommend the brand to others.

“These results underscore the importance of one of the key purchase drivers for many consumers: relatability,” explains Aimee Becker, Vice President of Strategic Services for Daymon. Shoppers are increasingly demanding products and services that reflect their unique needs and wants. Retailers and brands must take the time to research and understand what these needs and wants are, and the best strategies to deliver on them. When they do, not only will consumers reward them with sales—but also with loyalty and advocacy.

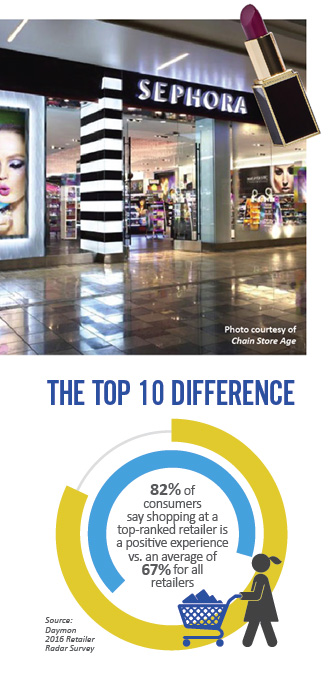

Beauty: Sephora—Elevating the Digital and In-Store Experiences

Beauty: Sephora—Elevating the Digital and In-Store Experiences

Like Publix, Sephora has managed to make serious gains where others have experienced declines. The beauty retailer has consistently grown its global store count by at least five percent each of the last five years and now reigns as the largest beauty chain with over 1,700 stores worldwide.

The secrets to Sephora’s success are two-fold. The retailer has been an innovator in reinventing the in-store beauty experience, and has also emerged as a leader in creating a seamless omnichannel experience for consumers. It was recently recognized with the 2016 Mobile Commerce Award from the Internet Retailer Excellence Awards.

Daymon’s own consumer research supports these strategies as key to making the retailer a leader not just in the beauty industry, but in the retail environment as a whole. Consumers give Sephora top marks for its in-store setup and ambiance, offering trial, and having skilled and knowledgeable associates. Nearly nine out of 10 shoppers say Sephora provides an experience they can’t get elsewhere—and would make a special trip to the store to buy Sephora-branded products.

On the digital side, 84 percent of shoppers say the retailer uses the latest technology to make their transaction seamless. Sephora has a robust digital arsenal that includes a website and mobile app, social media channels and in-store beacons that all work together to drive its brand strategy.

There are three key lessons other retailers and brands can learn from Sephora’s success:

- Allow for sampling and trial. Letting shoppers try before they buy goes a long way to boosting consumer engagement and loyalty.

- Rethink your merchandising strategy. Strategies like regularly changing up displays and creating unexpected product curation stations throughout the store gives shoppers something new to discover.

- Make digital a priority. “If you’re going to be a successful retailer—or business in general—digital must be enmeshed at the highest level,” Julie Bornstein, former chief marketing and digital officer for Sephora, told the Harvard Business Review in 2014, prior to her departure from the retailer.

Pet Products: PetSmart—Delivering on Differentiation and Curation

Specialty stores like PetSmart are facing competition from nearly every direction—discounters, mass merchandise, online and more. Still, the chain remains the largest pet products retailer in North America, with nearly 1,500 stores and growing.

As U.S. consumers increasingly come to see their pets as members of the family, PetSmart has stepped up to not just offer food, toys and other supplies at its stores, but to provide a true destination for pet owners. Many PetSmart stores offer training classes; vet, boarding and grooming services; doggie daycare; and pet adoption services. And all encourage visits from the whole family—human, furry, feathered and scaly alike.

According to Daymon’s proprietary insights, it’s this range of products and services that helps make PetSmart a leader in consumers’ minds. Nine out of 10 consumers praise PetSmart for always having the products they want in stock and for carrying specialty items or other specific products they’re looking for. Four out five say the retailer provides unique products and services they can’t find elsewhere, as well as new and interesting products to try and buy. What’s more, 70 percent say they would make a special trip to the store for PetSmart private brand items, versus the national average of less than 50 percent.

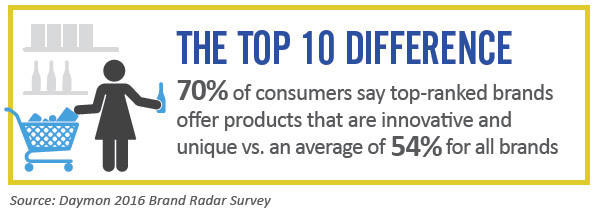

At a time when up to 98 percent of the products on store’s shelves are the same as its competitors, curating unique offerings is critical to success. As the findings above show, private brand can be an ideal way for retailers to differentiate. “Breakthrough innovation, not just ‘fast follower,’ will be more important than ever to use private brand as a competitive advantage,” says Dave Harvey, Vice President of Thought Leadership for Daymon. “And shoppers are now more willing to accept that unique ideas can come from a retailer’s brand.”

“In addition, exclusive offerings from retailers are moving beyond product to include services as well. As consumers seek experiences, not just transactions, uniquely branded services are becoming just as important to a private brand portfolio as item offerings.”

Wondering How Your Brand Stacks Up?

Based on the valuable insights gleaned from its proprietary surveys, Daymon is introducing a new service to help its retailer and brand partners assess the health of their business and to identify opportunities for growth and improvement. Through a “DayOne Assessment,” Daymon uses proprietary, syndicated and customized research to evaluate a retailer or brand’s competitive position, customer proposition and resource alignment.

“Our DayOne Assessment identifies key opportunity areas for our partners to compete more effectively in the rapidly changing retail environment and to create a closer connection between their brand and their consumer,” says Aimee Becker, Vice President of Strategic Services for Daymon.

Insights from the assessment could reveal, for example, that while retailer’s private brand products score high on relatability, they aren’t seen as innovative or as attention-grabbing as similar brands. By rethinking assortment, package design and product positioning with the help of Daymon’s end-to-end line of services, the retailer could stand to grow not only private brand share, but also consumer loyalty—two measures that research from the American Consumer Satisfaction Index shows are highly correlated.

To learn more about Daymon’s DayOne Assessment, contact Aimee Becker, Vice President of Strategic Services, at abecker@daymon.com.