AmazonFresh, Instacart, Netgrocer, Peapod, Plated, Blue Apron, HelloFresh, PeachDish—and the list goes on. These are just a few of the many alternatives consumers now have to going to a traditional grocery store to stock their fridges and pantries. Since the very first online grocery shopping service hit the scene nearly two decades ago, sales and consumer adoption have slowly, but steadily grown—at least until the last few years, when that growth seems to have finally caught fire.

According to research firm BI Intelligence, e-commerce grocery sales are expected to grow by 21 percent by 2018—compared to just over three percent growth for traditional brick-and-mortar grocery stores. And financial services firm Morgan Stanley predicts consumer adoption of grocery e-commerce will soar from 16 percent in 2015 to 28 percent by the end of 2016.

Should brick-and-mortar grocers be worried? Yes. But is it a lost cause? Absolutely not. This month, Retail News Insider investigates the top e-commerce trends impacting the grocery landscape today, what the future holds—and how traditional retailers can keep up.

Winners in the Online Market

Over the last 15 years, a number of players have entered the online grocery market. Looking at those that have had the most staying power, there are three main types of e-commerce grocery services that have been successful in capturing consumers’ attention (and dollars): grocery home delivery, click-and-collect and meal kit services.

Grocery home delivery—the full-service option that lets shoppers add everything from tomatoes to toothpaste to their online carts and have them delivered directly to their doorstep—is the model that started it all nearly two decades ago. And it’s still going strong today, with traditional grocery retailers like Ahold and Safeway, online retailers like Amazon, and third-party services like Instacart and Google Express all getting in on the mix. (For those who aren’t familiar, third-party services essentially function like a personal shopping service, allowing consumers to order from multiple retailers—even those without their own online/delivery services.)

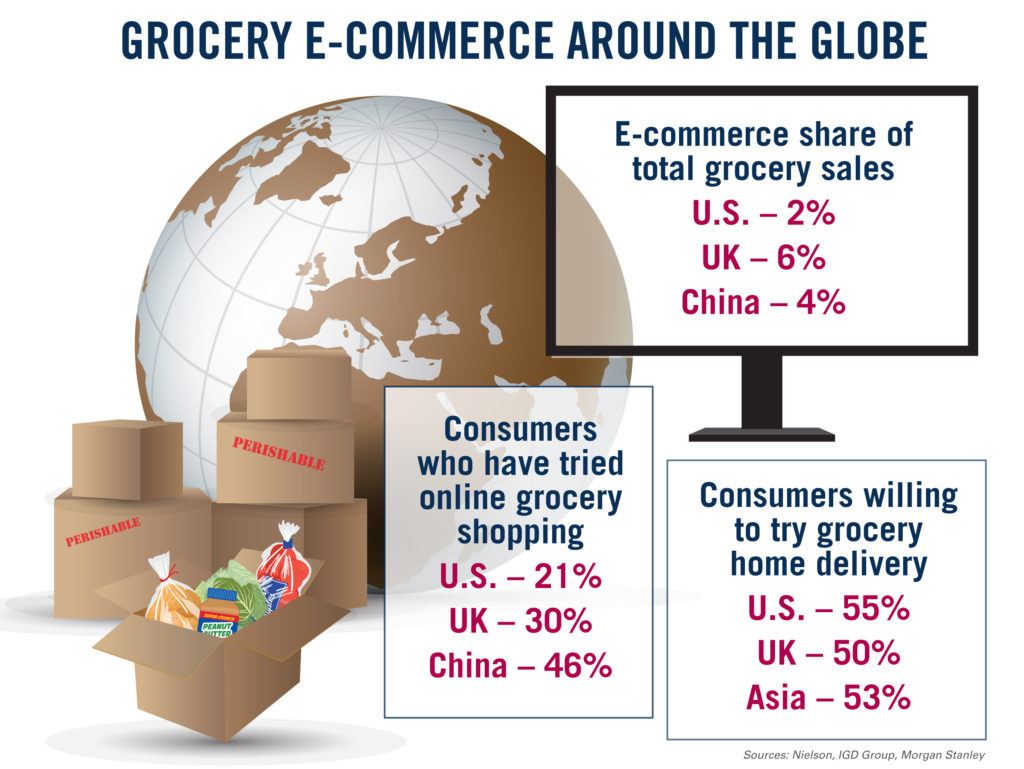

This model has been especially popular in Europe and Asia, but somewhat slower to become mainstream here in the U.S., particularly as the sole method of grocery shopping. A recent survey by Morgan Stanley showed that 67 percent of consumers who have never shopped online cite wanting to choose their own fresh products (fruit, vegetables, meats, etc.) as the top reason. That same survey showed that while 16 percent of Americans have purchased packaged foods online in the least year, only 8 percent have bought fresh items. Another turn-off for many consumers are the shipping costs and service fees often associated with home delivery.

In an effort to mitigate such concerns, and to lower retailers’ own costs, click-and-collect models have become another major player in the e-commerce market. This model typically involves ordering items online, then picking them up at a traditional grocery store, locker or dedicated drive-thru. In most cases, service costs are lower than home delivery—and consumers often have the option of inspecting their groceries before accepting them. Some consumers may also choose to order staples via click-and-collect, then make a separate, shorter in-store trip for fresh items. According to market research firm Nielsen, U.S. consumers who don’t currently shop online say they would be more willing to try click-and-collect models (57 percent) versus home delivery (55 percent).

The newest player to enter the e-commerce grocery market are meal kit services. These are typically subscription-based models, where users sign up for a set number of meals each week and the services ship them all the ingredients ready to cook, along with the recipe. These services tap into the market of consumers who want to cook at home rather than eat out, but who don’t have the time or inclination to find recipes, plan meals and shop on their own.

Though meal kit services have only been around for a few years, they have already exploded into a $1.5 billion market. And while survey firm CivicService puts U.S. trial at only about 4 percent, they note that these services may be tapping into bigger wallets—with most consumers who make at least $100,000 per year being most likely to try one. Those same consumers tend to have bigger basket spends, which means there’s potentially more at risk for traditional retailers.

How Brick-and-Mortar Grocers Can Stay On Top

While grocery e-commerce will continue to grow for the foreseeable future, that doesn’t mean traditional grocers are doomed to sit idly by while their sales decline. Nor can they rest on their laurels on the assumption that the majority of consumers will always prefer to shop in-store as they do today.

“There’s a real danger in becoming complacent,” says Ryan James Dee, Creative Director for Interactions. “It would be foolhardy for traditional retailers to ignore the fact that these e-commerce services exist, much like twenty years ago when bookstores thought people would always want to come into the store to peruse books. But look at where they are now. You can’t ignore it. Times are changing.”

So what’s a retailer to do? “There would be very few supermarkets who wouldn’t benefit and see their sales benefit from offering an online option,” says Bill Bishop, Chief Architect of Brick Meets Click, a consultancy firm dedicated to helping grocers focus on growth opportunities at the intersection of brick-and-mortar and online retailing. “Some should obviously be thinking more aggressively than others. But, with very few exceptions, most should have it covered in some way to avoid that loss of sales, so shoppers [who want to shop online] aren’t forced to go somewhere else.”

Bishop points out that this doesn’t necessarily mean retailers have to build their own online solutions from the ground up. Partnering with a third-party delivery service, such as Instacart, Google Express or Postmates, can be a viable option with lower initial investment and infrastructure requirements.

All grocers, whether they have an online option or not, can also benefit from increasing their digital connections with shoppers, says Bishop. According to a study by Brick Meets Click, the more digital connections a consumer has with a retailer (think interactions via e-mail, websites, social media, texting, etc.), the more likely the consumer is to become a primary shopper. And primary shoppers—people who consider a particular retailer their primary grocery store—spend nearly three times as much money with that retailer than with others.

In order to make these digital connections, Bishop emphasizes the importance of having accurate and up-to-date contact information for consumers. “It’s not unusual for a retailer to say they have 20,000 customers in their loyalty program, but it turns out 3,000 of those accounts are obsolete and only about 7,000 have up-to-date phone and email information,” he says. “Correcting this is something [retailers] can act on right away… and the difference, in terms of engagement that a retailer has with consumers, leads to a much more engaged and much more loyal shopper.”

“It also behooves retailers to amplify the in-store experience,” adds Dee. Grocers have to make their brick-and-mortar stores places that shoppers want to keep coming back to. “There are certain niche stores, like Trader Joes and Whole Foods, that people want to go in because they know they’re going to find something unexpected,” explains Dee. “Traditional retailers can do the same thing. They can do experiential events or bring in new products or introduce shoppers to new flavor profiles in order to keep them engaged and in the process, increase loyalty.”

“As we are quickly learning in food retailing, experiences, not products, are the key drivers of success.”

—Carl Jorgensen, Director of Global Consumer Strategy for Daymon Worldwide

Meal kits are another way for retailers to deliver positive experiences to shoppers—and to directly compete with online offerings. “Many meal kit customers report that they learn new cooking styles and techniques, as well as experience new flavors from meal kits. These are experiences that they might not otherwise have. And as we are quickly learning in food retailing, experiences, not products, are the key drivers of success,” says Carl Jorgensen, Director of Global Consumer Strategy for Daymon Worldwide.

“Meal kit delivery services are still in their infancy, so it’s the prime time retailers to stake their claim and come up with their own versions,” adds Dee. “In fact, they can be even better than a meal kit service. They literally have the entire store at their disposal to create their own make-and-take meals or recipe kits. And consumers don’t have to subscribe or worry about picking out their meals on time. They can just go into the story on any given day and know there will be a solution waiting there for them.”

Whether it’s improving the in-store experience, increasing digital connections or developing their own online options, with over $600 billion in in-store grocery sales at stake, traditional grocers have all the reason in the world to act—and to act now, before the e-commerce options grow larger and more competitive.