By Retail News Insider

“It’s the most wonderful time of the year” is not just a lyric from Andy Williams’ holiday classic. It’s reality for many retailers, who count on the holiday shopping season for up to nearly 20 percent of their total sales for the year, according to the National Retail Federation (NRF).

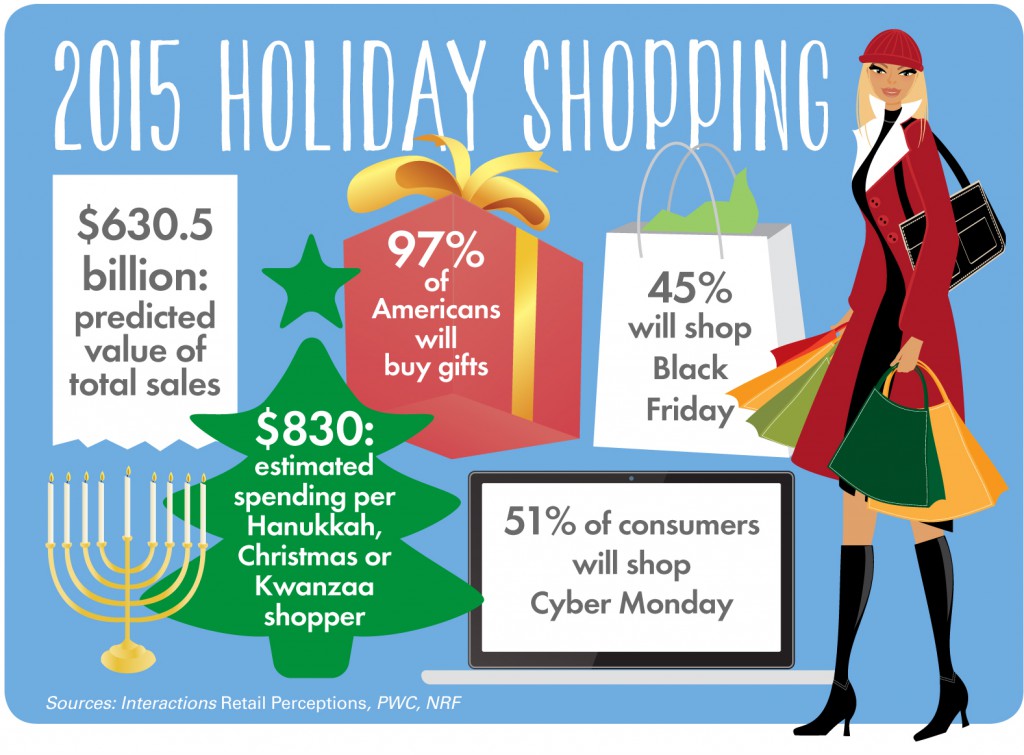

Since the recession, retailers have had to compete more fiercely than ever to capture their piece of the over $600 billion holiday sales pie. As a result, many have turned to earlier and more frequent sales, competing to be the first to open on Black Friday (or even Thanksgiving), offering big discounts online and employing clever ways to get shoppers to spend. Will this year be more of the same? Or do retailers have new strategies up their sleeves? Here’s a first look at the top 5 trends to watch this holiday shopping season.

1. Smaller Discounts, Fewer Sales

As consumer spending inches upward, many retailers are looking to get away from the heavy discounting and frequent sales they relied on during the recession and are instead focusing on service and the customer experience to generate sales. For example, high-end department store Nordstrom recently announced plans to reduce the number of clearance sales by 20 percent this year. Instead, the company says it plans to focus on providing service and differentiated products—in other words, those that shoppers can’t get at a discount elsewhere. Clothing retailers Abercrombie and Fitch and Aeropostale have also stated they plan to minimize promotions and focus on offering higher-quality, on-trend items at full price.

Other retailers started pushing holiday shopping earlier this year—some even before summer ended. Walmart launched its holiday layaway program on August 28, and Kmart began advertising its program the first week of September. Retail analysts say moves like these often encourage shoppers to start buying earlier, before they expect big discounts. It may also help reduce the amount of merchandise left to discount come prime shopping season. Retailers may also get an extra boost from earlier sales based on the fact that Hanukkah starts 10 days earlier this year as compared to 2014.

Based on Interactions’ latest Retail Perceptions report “The Holiday Shopper: Trends to Expect this Season,” encouraging those early sales may well be the right idea. The majority of consumers surveyed (64 percent) said they planned to start their holiday shopping before Thanksgiving, and one-third before Halloween.

2. More Stores Stay Closed on Thanksgiving

The past several years, an increasing number of retailers have tried to lure in eager Black Friday shoppers by opening their doors on Thanksgiving. But that trend may be reversing this holiday season. By mid-October, several big-name retailers, including GameStop and Staples, announced plans to stay closed on Thanksgiving. They’re expected to join the numerous retailers that have openly boycotted Thanksgiving Day sales in previous years, including Costco, Nordstrom, Dillards, TJX Stores, Pier 1, Home Depot and Lowes.

This pushback could be due in part to consumer sentiment—a 2014 survey by technology company RichRelevance showed 62 percent of Americans either “hate” or “dislike” the practice of shopping on Thanksgiving. But it might also be about the bottom line. Opening on Thanksgiving Day means extra costs for retailers. However, according to retail analytics firm ShopperTrak, most stores that stayed open on Thanksgiving last year didn’t see a big boost on their overall holiday sales to offset those costs. Instead, increased sales on Thanksgiving were largely offset by decreased sales on Black Friday.

“People are changing their behavior,” said ShopperTrak founder Bill Martin in an interview with the Associated Press. “We’ve seen this for two years in a row now. Stores opening on Thanksgiving are simply eroding sales from Black Friday.”

3. Trust Reigns Supreme

According to consultancy firm PWC, brands that make an effort to secure consumers’ trust can expect to come out on top this holiday season. PWC notes that “86 percent of consumers will only shop the brands they trust: visionary brand leaders who take risks, embrace new challenges, and excite the imagination… When shoppers trust a particular brand, their loyalty extends throughout its entire product line and through holiday purchasing decisions.”

Brands can garner this kind of trust by providing consumers with an exceptional brand experience across all channels. High-quality, personalized service can also help draw consumers in and keep them coming back. Behind the scenes, a close attention to security may also play a role. According to PWC, 42 percent of consumers say they won’t shop at a retailer who has experienced a security breach in the last 12 months. In a similar vein, “The Holiday Shopper” report revealed that, as a result of recent security breaches, 10 percent of shoppers plan to purchase only from retailers they trust to prioritize the security of their personal information.

4. Mobile Shopping Takes Off

Mobile shopping, also referred to as m-commerce, has been slowly increasing over the past several years but this holiday season, experts predict it will reach new heights. Interactions’ “The Holiday Shopper” report showed that 49 percent of consumers plan to use a mobile device to shop this holiday season. Analytics firm eMarketer expects m-commerce sales in the U.S. to rise over 32 percent—more than double the increase forecasted for e-commerce (online) sales.

In addition to shoppers becoming more comfortable with using their mobile devices for shopping, m-commerce may also get a boost this year as social shopping sees its first holiday season. Most of the top social media sites, including Pinterest, Facebook and Instagram, have recently introduced “buy” or “shop now” buttons that make it easy for consumers to shop via the sites. Given that nearly three-quarters of all smartphone owners use their device to access social media, according to Pew Research, the potential for increased m-commerce through social media is high.

5. Shopping Continues Post-Holiday

Retailers shouldn’t expect crowds to die down as soon as the holidays are over this year. In fact, experts say that December 26 has become the second busiest shopping day of the year—coming in just behind Black Friday.

In 2014, “sales were up 8 percent on December 26 and 27, thanks to in-store foot-traffic. Consumers knew there would be post-holiday markdowns and factored that into their shopping plans,” explains Andrea Van Dam, CEO of media strategy firm Women’s Marketing.

All in all, most retail experts agree the holiday shopping season will indeed be wonderful for retailers’ budgets this year. The NRF is expecting November and December sales to rise 3.7 percent over 2014 levels, which is significantly higher than the 2.5 percent year-over-year average seen over the last decade. eMarketer has an even rosier outlook, predicting holiday sales to rise 5.7 percent over last year. According to Interactions’ findings in “The Holiday Shopper” report, retailers can influence where shoppers spend those extra dollars by offering high-quality merchandise, good customer service and an engaging shopping experience.