How consumers view health and wellness is changing—shifting from a reactive to a proactive culture. No longer is the sole focus on treating disease. Today, consumers seek preventative care and alternative approaches to promote their overall health. At the same time, self-knowledge is expanding dramatically. Sophisticated data-tracking tools are becoming mainstream, enabling users to monitor their daily fitness, dietary and other lifestyle habits. DNA profiling is also becoming more affordable and accessible, allowing consumers to scan their DNA for genetic markers of disease, dietary intolerance and more. Gone are the days of a one-size-fits-all approach to “better for you.”

Advancements in technology and their reach into mass market, combined with consumer demand for personalized solutions tailored to their unique needs are growing in tandem at an accelerated rate. The stage has been set for a “Precision Wellness” boom. This next generation of wellness—focused on targeted recommendations and products for individual health concerns and wellness needs—provides a growing number of opportunities for retailers and brands to create more personalized offerings for the self-aware shopper. In this first of a two-part series on precision wellness, Retail News Insider teamed up with Daymon’s Thought Leadership group to take a closer look at the impact of wearable technologies on consumers’ buying habits—and their role in the future in retail.

Wearables Today

According to mobile device research firm CCS Insights, over 90 million wearable devices were sold last year—a number expected to more than double by 2021. The most common wearable devices in use today are activity trackers—small devices worn on the body to track heart rate, number of steps walked or run, calories burned and sleeping patterns. There are dozens of versions of these devices on the market today, including dedicated trackers (like the FitBit Flex and Striiv Fusion), as well as smartwatches that act as both activity trackers and an extension of the user’s smartphone (like the Apple Watch and Samsung Gear).

Many of these devices, especially dedicated trackers, are paired with a proprietary smartphone app exclusive to the device. However, there are also a growing number of independent apps that can be used interchangeably with a variety of different devices. Fitness companies, health insurance providers and even some retailers are getting in on the action with their own apps that motivate users through challenges, daily tips, rewards and more.

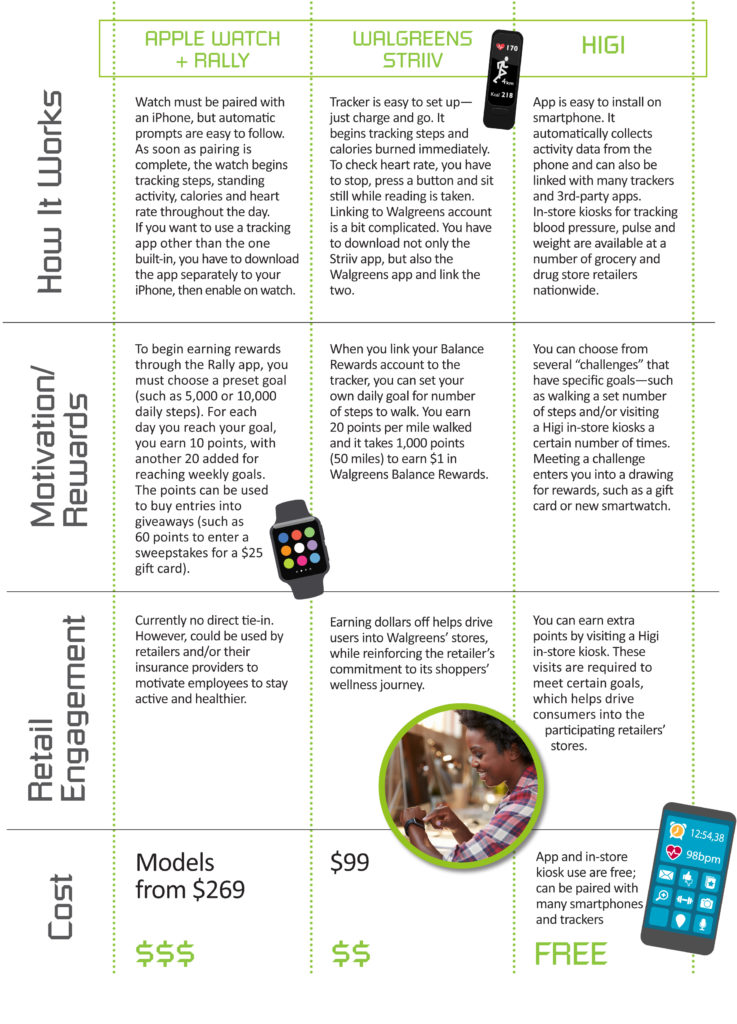

To see just how these devices and apps work—and how they can be used to drive retail engagement—we tested out a combination of three: the Apple Watch paired with Rally (an app provided by our tester’s health insurance provider), the Walgreens Striiv Activity Tracker (with proprietary app), and Higi (an app and in-store kiosk provider).

Our testers’ initial impression of all of these devices and apps was that the motivation to use them starts out strong, but tends to wear off without regular engagement and generous incentives by the retailer or brand.

Our testers’ initial impression of all of these devices and apps was that the motivation to use them starts out strong, but tends to wear off without regular engagement and generous incentives by the retailer or brand.

Daymon’s Thought Leadership agrees that there is significant room for improvement in the types of retail-engagement strategies currently being used. “Although wearables have been around for several years, the understanding of how that data can be used on a broader scale is still evolving,” says Carl Jorgensen, Director of Wellness Thought Leadership for Daymon. He notes, however, that there are some promising models that a few progressive retailers have begun to build around the concept.

One such example is the 2016 FitBank program run by San Francisco-based Andronico’s Community Markets (prior to their merger with Safeway). “With Andronico’s program, shoppers received points for tracking their workouts and activities. Those points could be turned into gift cards toward buying a list of healthy foods at the store. The retailer also linked the program with the larger fitness community, partnering with a number area gyms and exercise centers,” Jorgensen explains. It also featured periodic in-store events where shoppers could consult with nutritionists, chefs and fitness coaches.

Jorgensen goes on to explain that not only is such a multi-pronged approach necessary to keep shoppers motivated and engaged, retailers also stand to gain. “By linking rewards to specific in-store products, the retailer can increase sales and loyalty. And the motivation and expertise the retailer provides can strengthen the relationship with the customer. It helps establish the retailer as the shopper’s partner in the wellness journey.”

“Retailer’s shouldn’t overlook opportunities to link these efforts to their private brands,” adds Dave Harvey, Vice President of Thought Leadership for Daymon. “That’s an even more effective way to connect the message to the store—and it offers something the shopper can only get at that retailer.”

With many devices tracking calories and sleeping patterns, this link could easily be made through food and over-the-counter health products. For example, a retailer could color-code meal solutions around aggregate calorie count—helping shoppers quickly identify and add up products that meet their calorie targets for the day. Curating products targeted to sleep concerns revealed by activity trackers—such as waking up frequently in the night—could be another avenue to pursue.

What the Future Holds

The wearable trackers and smartwatches that dominate the market today are just the tip of the iceberg when it comes to the potential of wearable technology. As newer and more diverse applications come to market, the opportunities for retailers to use wearables to engage with shoppers will also grow.

One significant change many experts predict is a move away from dedicated device-driven technologies to more integrated applications. “[We] see the wearables market moving away from screens and hard electronics to fabric-like materials which are soft, thin and flexible,” says Ezgi Ucar, Director of Product Development for LOOMIA, a startup company creating functional sensing systems that can be used in smart textiles.

“The shift from hard wearables to soft wearables is not only for comfort, but also to make wearables a part of the user’s everyday experience,” she explains. “The more gadgets that are introduced into our everyday interactions, the harder it gets to organize them and make efficient uses for them. Why add another gadget into your life, when your shirt or your shoe can do the same job?” This kind of integration will make wearables a more common part of consumers’ day-to-day lives over the next five to 10 years, predicts Ucar.

“The shift from hard wearables to soft wearables is not only for comfort, but also to make wearables a part of the user’s everyday experience,” she explains. “The more gadgets that are introduced into our everyday interactions, the harder it gets to organize them and make efficient uses for them. Why add another gadget into your life, when your shirt or your shoe can do the same job?” This kind of integration will make wearables a more common part of consumers’ day-to-day lives over the next five to 10 years, predicts Ucar.

Another shift already appearing in prototypes for up-and-coming wearables is the integration of assistive functionalities. For example, Rythm, a French neuro-technology startup, is developing a wearable headband that not only tracks sleep patterns, but also analyzes them in real-time and emits targeted sounds to help improve sleep quality. “Pairing this kind of device with sleep-related consumables, like teas, skin creams and supplements to promote relaxation, could be another way for a retailer to show how they can be a true wellness partner,” says Jorgensen.

There’s little doubt that the focus on wellness and related wearable technology trends will continue to grow and evolve in the coming years. As retailers look for ways to differentiate in the face of ever-increasing competition, early adoption and innovative thinking around this space could well be one of the keys to success.