By Retail News Insider

By Retail News Insider

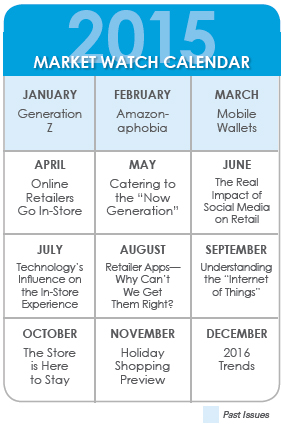

Most of us have been there before: staring at our computer screens contemplating a purchase, but wishing there was some way we could actually see, feel and try out the product before making the investment. For many brands, that can be done fairly easily, hence the popularity of showrooming and webrooming. But for online-only retailers selling exclusive own-brand products, shoppers have long been out of luck.

The act of researching products inside a brick-and-mortar store before purchasing them online.

Webrooming (verb):

The act of researching products online before purchasing them at a brick-and-mortar store.

That tide is beginning to turn, however, as studies—and sales—continue to show the overwhelming influence of brick-and-mortar. According to a recent survey from management consulting firm A.T. Kearney, 90 percent of consumers prefer to look at products in-store—even if they ultimately purchase online. In addition, the U.S. Commerce Department reports that 94 percent of sales still take place through traditional retail channels. As a result, many virtual retailers are looking for ways to adapt and capture both in-store and online audiences. And in a surprise move, some are turning to brick-and-mortar retailers for help, setting up shop right inside their stores.

The store-within-a-store concept isn’t new. Large retailers like Macy’s, Neiman Marcus and Bloomingdales have been doing it for years by giving certain clothing designers, cosmetics companies and other brands dedicated spaces on their sales floors. Similarly, leading grocery chains like Giant Eagle, Safeway and Kroger have partnered with banks, dry cleaners and other service providers to offer multiple services under one roof. But partnering with virtual retailers broadens the horizons for brick-and-mortar retailers.

While some may worry that allowing another retailer to set up shop within their store is a recipe for cannibalized sales, the reality is that partnering with virtual retailers can have many benefits. Here are 5 ways these partnerships can benefit brick-and-mortar stores.

1. Get a direct boost to the bottom line.

Clearly brick-and-mortar retailers aren’t going to simply invite virtual retailers into their footprints without asking anything in return. One of the most common ways they operate and benefit from store-within-a-store arrangements is to charge their partners rent for the space they’re using.

This additional income can be especially appealing to the many large brick-and-mortar retailers who are finding the “bigger is better” motto of the late 1990s and early 2000s no longer holds true. Partnering with virtual retailers can help them “right size” their sales footprint without downsizing their profits. For example, department store Sears has been shrinking its inventory over the past few years. But rather than moving to smaller locations, the retailer has signed partnerships with uniform supplier Work N’ Gear, golf store Edwin Watts and others to lease freed-up space within existing Sears’ stores. The partner retailers and brands benefit from the established location and existing foot traffic, while Sears displaces potential lost sales income with lease profits.

2. Gain expertise in new areas.

Though the majority of consumers prefer to experience products in-store, that doesn’t mean they always buy them there. Nor does it mean if you build a store, they will come. Brick-and-mortar retailers still have to capture consumers’ attention—and in today’s digital world, that means having a robust online presence.

For retailers who don’t have that digital know-how within their own organization, partnering with a virtual retailer can be an ideal solution. The sharing of digital expertise was of key interest to Nordstrom when it made a deal to sell online retailer Bonobos’ menswear collection inside Nordstrom department stores. In an interview with The New York Times, Nordstrom’s Executive Vice President Jamie F. Nordstrom said the retailer was especially impressed with the way Bonobos interacted with consumers and wanted to harness that talent to augment its own digital strategy. Nordstrom has since been heavily investing in e-commerce over the past several years, spending millions on updates to its mobile apps and Nordstrom.com interface, thanks to the help of the Bonobos team.

3. Expand specialty offerings.

With margins that are often very thin, most retailers—especially grocers—can’t take the risk on buying expensive stock for specialty items that haven’t been proven to sell in their stores. Allowing a virtual retailer to set up an in-store presence can be an ideal way for traditional retailers to break into different markets and draw in new customers.

This is what leading grocery retailer Kroger and New York-institution Murray’s Cheese have done to bring specialty cheeses to consumers in Florida, Ohio, Indiana, Colorado and beyond. While not a fully virtual retailer, Murray’s Cheese has just two small physical locations, both in New York City, with much of the rest of its nationwide business going through its e-commerce site. Via the new partnership, Kroger is giving shoppers a one-of-kind opportunity to try out specialty cheeses and get expert advice from Murray’s educated, in-store cheese mongers—right in their own neighborhoods. The venture has been quite successful, starting out in just a handful of stores in 2008 and growing to over 100 mini-Murray’s shops inside Kroger banner stores today.

4. Capture new audiences.

Brick-and-mortar retailers can also benefit from an expanded audience when they partner with virtual retailers. This is what Long’s Jewelers, a small jewelry store chain in the Boston area, discovered when it partnered with online jewelry designer Ritani. In the partnership, consumers who buy from Ritani’s website can have orders shipped to a local Long’s store in order to inspect the design before the purchase is final. In exchange, Long’s gets a portion of the profits—and has seen a significant increase in new customers who wouldn’t have been likely to visit its stores otherwise.

“It’s been a win-win strategy that’s leveraged both of our strengths,” the owner of Long’s Jewelry, Craig Rottenburg, said in an interview with The New York Times. “We get the halo effect from the tremendous work [the virtual retailer] does marketing and building a world-class e-commerce experience.”

5. Offer greater convenience and value.

Another option is for traditional retailers to partner with online brands and retailers to offer complementary products, making consumers’ shopping experiences more convenient and their own stores more valuable.

One example of this today is the partnership just announced between Sainsbury, the U.K.’s second-largest grocer, and Argos, the U.K.’s leading provider of general merchandise. (While Argos has its own physical locations, it operates most similarly to a pure-play virtual retailer, with products being delivered to consumers sight-unseen.) Starting this summer, consumers already doing their grocery shopping at select Sainsbury stores will be able to visit the in-store Argos shop to purchase the barbeque grill, cake pan or set of knives they need to complete the meals they’ve been shopping for—or even the dishes and dining table to serve them on.

If nothing else, the one thing that should be clear from the growing partnerships between virtual and brick-and-mortar stores is that retail is no longer the “either-or” game we once thought it to be. E-commerce isn’t going away, but neither is in-store shopping. Rather than trying to outdo each other, combining the benefits and expertise of both may just be best plan yet.