When you think of the “typical” shopper today, what do you see? Is it a mother with a couple of children in tow, or young, fit men and women outfitted in the latest fashions? Many mainstream retailers and brands present these as their vision for the typical shopper—and they are doing so at the expense of leaving segments of shoppers, and dollars, behind.

The reality is that there is no “typical” shopper. Consumers come in all shapes, sizes and ages, and from all different types of families and households, says Dave Harvey, Vice President of Thought Leadership for Daymon. “One of the major trends affecting retail today is what we call the ‘modern family’. It is comprised of different shopper and household compositions, whether it’s singles, multi-generational families living under one roof, pet parents, roommates and so on,” he explains.

A growing number of retailers and brands across multiple industries are proving there are clear benefits to focusing on often forgotten consumer groups. We took a closer look at how three such retailer and brands have worked to meet the needs of some of these frequently overlooked shoppers—all the while building their brand image and boosting the bottom line.

Case Study: Honda Markets to the Middle Child—Generation X

Case Study: Honda Markets to the Middle Child—Generation X

Marketers and brands have long been fans of marketing to the largest consumer generational groups. Today those include Baby Boomers (older adults), Millennials (young adults) and Generation Z (kids and teens). But what about the over 1.3 billion global consumers in their mid-30s to early 50s? That’s Generation X—also known as the “forgotten middle child.”

Generation X is admittedly smaller than the generations that come before and after. But its buying power is nothing to overlook, especially as its members enter their prime earning years. That’s what auto maker Honda was counting on when it began retooling its marketing efforts to capture Generation X’s attention—and sales.

In 2007, Honda undertook a strategic plan to attract more 30- and 40-something buyers to its midsize sedan offering. The automaker conducted qualitative and quantitative research studies and ultimately redesigned its Accord sedan and media campaigns to create greater emotional appeal amongst Generation X consumers. These efforts paid off. By 2014, the Accord had reached the list of top five new car models purchased by Generation X buyers, according to a report by credit reporting agency Experian.

The auto maker took a similar approach with the redesign of its Odyssey minivan in 2011, again to much success. “Others have been concerned that Gen X isn’t going to give you the ROI, but we’re not afraid to target them,” Tom Peyton, Assistant Vice President of Advertising at Honda, said in a recent interview with AdAge. “Gen X is not quite as big and sexy [as millennials], but at the end of the day, they are prime time in their income and they can buy a lot of expensive new cars.”

Case Study: Destination XL Rebrands to Make Big & Tall Fashionable—and Profitable

Case Study: Destination XL Rebrands to Make Big & Tall Fashionable—and Profitable

Mainstream fashion designers and department stores have long catered to “standard” sizes—typically selling for men of about average height and weight. Need an inseam that’s much longer than 34 inches or a waist over 42 and you might be out of luck. Enter Destination XL (DXL): the leading U.S. retailer specializing in fashionable clothing for the Big and Tall market.

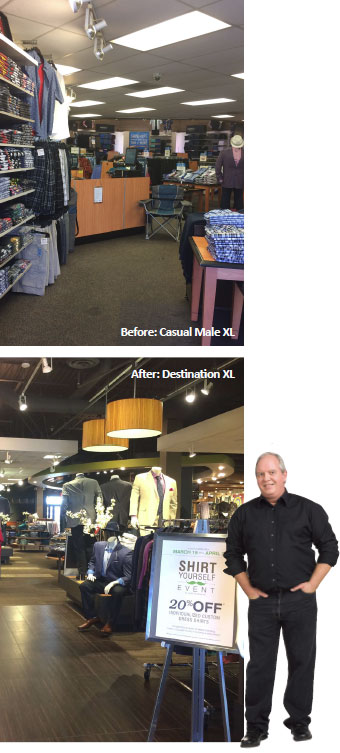

While DXL is now a highly successful fashion retailer, it wasn’t always that way. “We bought the company out of bankruptcy in 2002,” explains DXL Group CEO David Levin. At that time, most of the retailer’s stores were branded under the Casual Male XL banner. Even though DXL Group invested in and remodeled many of those stores, they ran into the same problems that had plagued the retailer for years.

“That’s when we stepped back and sat down with our customers to find out how they perceived our stores and what they were looking for in a shopping experience,” explains Levin. “We learned that they often thought of Casual Male as a place where their fathers shopped. The clothes weren’t fashionable, you couldn’t put an outfit together, the dressing rooms were too small. It just wasn’t the best shopping experience.”

The retailer set about transforming its stores to provide shoppers with a better experience—moving to larger more modern spaces, building bigger dressing rooms, and working with top designers like True Religion, Lacoste and Polo Ralph Lauren to make trendy clothing available to the big and tall market. Finally, to avoid any negative connotations related to the old brand, the retailer rebranded its new stores “Destination XL.”

Levin says that the results have been truly remarkable. At a time when most other retailers are shrinking, DXL is growing. They opened four DXL stores in 2010 and now have over 200. They’ve grown “end of the rack” customers—those who wear the largest sizes available in most mainstream stores yet make up 65 percent of men in the U.S.—from 25 percent of their business to 45 percent. Even in the online space, thanks to their focus on consistency in comfort and fit, they have a return rate of just eight percent, less than a third of the industry average.

Levin gives credit for this success largely to understanding and listening to consumers’ needs and providing what would be “forgotten shoppers” with a destination where they could find clothing that is right for them. “Our customers told us they wanted the same clothing that’s available in regular sizes and that they didn’t want to feel embarrassed to go shopping, so that’s what we delivered.” Now, says Levin, when a customer comes into a DXL store, he can be confident in knowing associates will help him find an outfit that will make him look good and feel good, winning him compliments—and bringing him back for more.

Case Study: Saffron Road—Feeding Generation M(uslim)

Case Study: Saffron Road—Feeding Generation M(uslim)

Muslim consumers are one of the fastest growing segments around the world. Today, there are over 1.6 billion global Muslim consumers hailing from more than 70 countries. In the U.S., Muslim consumers number almost four million—nearly the same number as Jewish consumers. But unlike kosher foods, which are widely available for Jewish consumers, few U.S. retailers and brands have yet to widely offer the Islamic equivalent—halal foods.

Despite potential controversies, CEO Adnan Durrani saw a market ripe with opportunity. So he capitalized on his experience in the food and beverage industry to found Saffron Road—a natural foods company dedicated to producing sustainable, socially-conscious and halal foods. Formed in 2010, the company launched a small line of frozen entrees adhering to halal standards (containing no pork or pork by-products, and using only other meats that are humanely raised and specially prepared according to Islamic law).

Saffron Road’s first major partner was Whole Foods, which helped introduce the products to a national audience. Since then, it has grown into an over $35 million company with more than 50 product offerings available at over 100 retailers and 12,000 locations across the U.S. The brand appeals not only to Muslims looking for halal foods, but also to younger, non-Muslim consumers looking for ethically-made options, said Durrani in a recent interview with Profile Magazine.

The Broader View

The success of retailers and brands like these has proven that there are significant opportunities in rethinking typical demographics. And others are taking note. For example, athletic footwear and sports apparel giant, Nike, announced in March it was releasing its new Pro Hijab—a breathable, modest head covering designed just for female Muslim athletes. Amazon also just launched a Spanish-language version of its U.S. site. And CPGs are beginning to acknowledge it’s not just women who do the household cooking and cleaning.

These moves are backed not only by previous success stories like those presented here, but also by simple dollars and cents. Consumers are willing to pay for solutions that feel personalized and targeted to their diverse needs. And often forgotten shopper groups have the spending power to do so. Generation X, for example, accounts for 31 percent of total U.S. income, according to market research firm Shullman Research Center, and the global market for halal products is estimated at $2.1 trillion, according to a Harvard Business Review study.

To rise to the challenge of meeting changing and varied consumer needs, retailers should embrace the concept of “de-labeling,” says Nicole Peranick, Director of Culinary Thought Leadership for Daymon. This means getting rid of the usual definitions of what typical households or couples or people should look like in order to be inclusive of a more diverse consumer landscape.

“We’ve seen good examples of this in the toy category, with brands developing dolls that reflect children with illnesses or disabilities, as well as in the beauty category, where brands like CoverGirl are now featuring not just young women, but also older women and even men,” explains Peranick. “But there are few other industries that are really doing this well as a whole, so there is a great deal of opportunity for retailers and brands alike.”

For retailers and brands that don’t broaden their approach, it’s not only sales that are at stake, but also brand confidence and loyalty as there is sure to be another retailer or brand waiting in the wings, ready to satisfy consumers’ needs and make them feel valued.