By Retail News Insider

By Retail News Insider

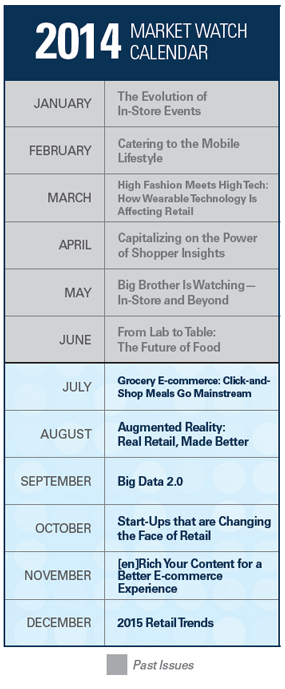

Over the next year, the number of consumers who shop for groceries online at least some of the time is expected to nearly triple, according to a recent study by research firm The Hartman Group. And by 2020, the market is predicted to grow to $50 billion, compared to the $13 billion it represents today, says Kantar Research. This growth is a clear sign that the tides are changing for grocery e-commerce.

It’s true that the concept of shopping for food online hasn’t taken off like other markets such as electronics and clothing. Services like Peapod and FreshDirect have been offering the service for years, but the market has continued to remain relatively small. However, as the statistics above show, that is slowly beginning to change as the line between consumers’ online and offline lives becomes increasingly blurred and they look more toward technology to meet their changing needs and wants. The good news for traditional retailers is that there are a variety of e-commerce models they can adopt to retain existing consumers who want more shopping options—and to capture new audiences.

A prime example of a traditional retailer leading the way in the grocery e-commerce arena is Ahold. In 2001, Royal Ahold (Ahold USA’s parent company) acquired the afore-mentioned Peapod service, which was originally an online-only grocery delivery company. Under its original model, Peapod orders were received online, picked at a distribution center and delivered directly to consumers’ homes. This is how most online-only grocery retailers work. But after its acquisition with Royal Ahold, Peapod changed up its model by partnering with two of Ahold USA’s banners—Stop & Shop and Giant—to expand its picking and service locations.

Curbside grocery pick-up

Photo courtesy of Peapod, LLC

Today, Peapod home delivery orders come from 2 centralized, stand-alone distribution centers that work like the original model, as well as over 20 “warerooms” that are attached to existing Stop & Shop and Giant stores. These warerooms have allowed Peapod to take advantage of the brick-and-mortar stores’ existing infrastructure, thereby containing costs while still allowing for market expansion. Several other retailers, such as Safeway, Hy-Vee and ShopRite, have begun offering similar brick-and-mortar-based home delivery services in select markets. This model often appeals to consumers who are well versed in other types of online shopping and who want to save time, money (fees are often more than offset by the avoidance of impulse purchases) and gas. For some, it’s also a solution to overcoming the challenges of living in a food desert—an area that lacks easy, direct access to fresh foods.

Home grocery delivery isn’t the only e-commerce model, though—or perhaps even the most popular. Again we look to Ahold who, in 2012, added another component to enhance its Peapod service: curbside grocery pick-up. Again, shoppers use the Peapod online portal to select and pay for their groceries. But instead of having the orders delivered to their homes, they choose a nearby Stop & Shop or Giant store to pick them up at on a certain day and time—bypassing the minimum order size and service fees associated with home delivery. In most cases, the orders are fulfilled with product that comes directly from the local store’s shelves, rather than from a separate distribution center or warehousing area.

This “click-and-collect” model, which has been used for years in the U.K., France and other European countries, has proven popular for Ahold. It now has over 190 pick-up locations at Stop & Shop and Giant stores throughout the Northeast and Mid-Atlantic. Several other grocery chains around the U.S., including Harris Teeter, Market District, Weis and Lowes Foods, have adopted similar pick-up formats as part (or all) of their e-commerce strategies as well. By using existing store infrastructure and avoiding extra costs associated with home delivery (drivers, vehicles and extra insurance, for example), it is often a simpler, more cost-effective way for retailers to enter the online shopping market. It also appeals to consumers who like the convenience of online shopping, but want to avoid higher home delivery fees and being tied to their homes while waiting for the delivery.

Taking a page from the click-and-collect model, a new retailer in the Midwest, Zoomin Market, has just started offering drive-thru grocery service—minus the actual grocery store. Like Ahold’s curbside pick-up service, groceries are ordered and paid for online, then picked up at a preselected time. But the pick-up takes place at Zoomin Market’s warehouse rather than a storefront. Living up to the true drive-thru concept, Zoomin Market associates load groceries directly into consumers’ cars, so there’s no need to even open the door. In an interview with The Kansas City Star, Zoomin Market cofounder John Yerkes explains that the drive-thru model has the same benefits for shoppers as other retailers’ curbside service, but it also saves the company by not having to pay for cashiers, store furnishings or the higher insurance costs of a regular walk-in market.

Another unique online grocery shopping solution some retailers are turning to—especially smaller ones—is to partner with an existing shopping service such as Instacart or Postmate. These services aren’t grocery retailers themselves, nor do they maintain any storefronts or distribution centers. Rather, they provide the online platform for consumers to place orders and the personal shoppers/drivers to pick up and deliver those items. Not all of the retailers consumers can order from using these services have formal relationships with each service itself. But for those retailers who do officially partner with such online shopping services, the benefits can be wide reaching. For example, it can allow retailers to dip a toe into the e-commerce market without the expense of creating a proprietary online shopping portal and to expand their reach into nearby areas or communities without having to invest in upgrading their infrastructure. Also, in the case of Instacart, shoppers are often offered better pricing from formal partner stores, thereby helping those retailers capture more sales that might otherwise have gone to a competitor.

Another unique online grocery shopping solution some retailers are turning to—especially smaller ones—is to partner with an existing shopping service such as Instacart or Postmate. These services aren’t grocery retailers themselves, nor do they maintain any storefronts or distribution centers. Rather, they provide the online platform for consumers to place orders and the personal shoppers/drivers to pick up and deliver those items. Not all of the retailers consumers can order from using these services have formal relationships with each service itself. But for those retailers who do officially partner with such online shopping services, the benefits can be wide reaching. For example, it can allow retailers to dip a toe into the e-commerce market without the expense of creating a proprietary online shopping portal and to expand their reach into nearby areas or communities without having to invest in upgrading their infrastructure. Also, in the case of Instacart, shoppers are often offered better pricing from formal partner stores, thereby helping those retailers capture more sales that might otherwise have gone to a competitor.

Despite slow initial growth, there’s no denying that online grocery shopping is finally becoming part of the mainstream. And the opportunity is ripe for existing brick-and-mortar retailers to get in on the action. They have the advantage of having an existing presence in the community and can capitalize on consumer loyalty and positive brand perception. Just like offering a combination of online and paper circulars or clip and mobile coupons helps reach the widest range of consumers, these retailers should look at e-commerce as a threat to in-store sales, but as a complement to it. It’s one more way they can deliver consumers the experience they want, when they want it and where they want it.